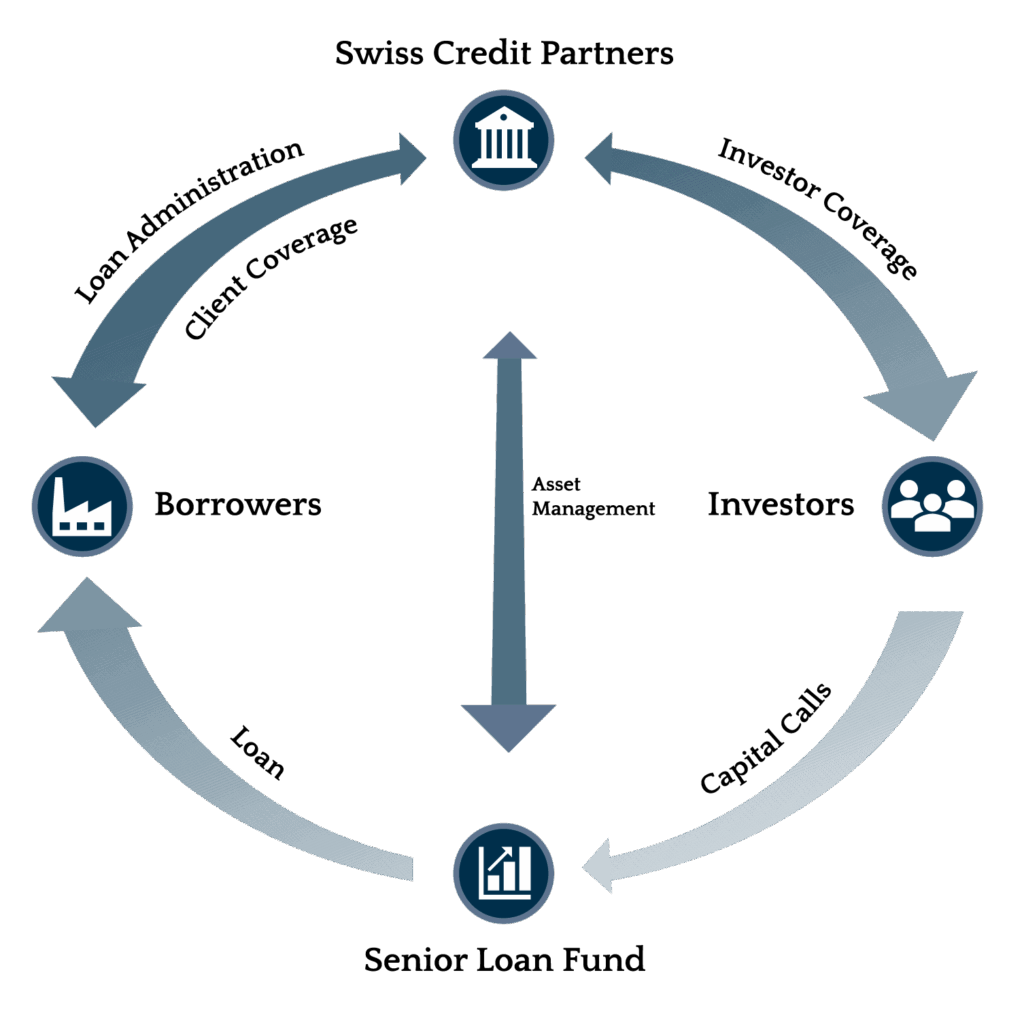

Historically, the market for corporate financing solutions has been dominated by large Swiss banks. The current market landscape is undergoing fundamental change which creates a new demand for bank-like financing solutions. With an innovative new business model and strong investors’ commitment we offer and build long term value, tailored to the needs of borrowers and investors alike.

Investor capital committed as per today

Strategic investors

Our mission

Our mission is to be the partner of choice for loan financing solutions for large and mid-sized Swiss Corporates and financial sponsors.

We achieve this by drawing on our in-depth and proven industry-leading corporate finance experience and expertise in the Swiss and German-speaking market. We understand that every corporation’s financing needs are unique. We are committed to dedicating our full focus and attention to delivering financing solutions and structures that help our borrowers achieve their financial aspirations, while employing rigorous risk management standards, ensuring that our lending activities are at all times commensurate with our target risk profile.

Building on the strong foundation of our strategic investors (CHF 1.2bn capital commitments) we are continuously looking to expand our institutional and professional investor base.

ESG

At Swiss Credit Partners, we have designed our investment strategy with a long-term, sustainable view, where responsible investing is central to our approach, allowing us to generate enduring value while carefully managing ESG risks.

Environmental, Social, and Governance (ESG) factors are seamlessly integrated into our investment process, forming a key component of our credit analysis. We apply pre-defined ESG criteria to every investment opportunity, ensuring that only transactions with at least a medium ESG risk rating are considered. Our investment decisions are guided by the SASB Materiality Map, and we conduct comprehensive ESG assessments as part of our due diligence.

Our commitment to sustainability is further strengthened by continuous monitoring and transparent ESG reporting, ensuring accountability to both our investors and stakeholders.